Why Iran?

Iran possesses great potential for renewable energy, with wind and solar energy resources

standing out as the most promising among all renewable options in the region.

In response to surging power demands, decreasing fuel subsidies, and a pressing need for

enhanced energy security, the Iranian government and policymakers have demonstrated a keen

interest in the renewable energy sector. A notable stride in this direction has been the

establishment of a target of 5 GW in installed renewable energy capacity by 2020. Furthermore,

SATBA, the country’s renewable energy organization, has implemented feed-in tariffs as an

additional incentive policy. These tariffs ensure a consistent payment for power purchases over a

20-year period.

Solar Energy

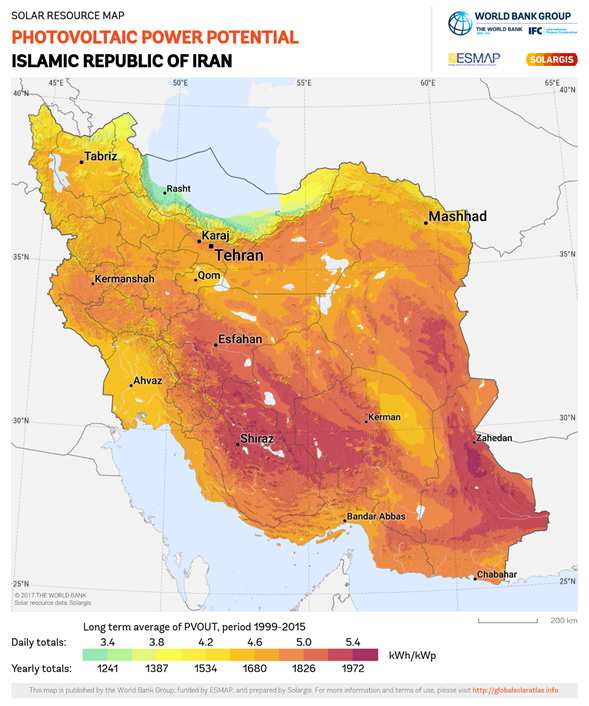

Iran possesses excellent potential for solar photovoltaic (PV) energy, with an average solar

radiation of 4.5-5.5 kWh/m2 and over 300 sunny days per year covering more than two-thirds of

its total area. The central and southern regions experience the highest concentration of sunlight.

Situated on the Solar Belt, Iran stands among the countries with abundant solar resources and is

recognized as an ideal location for harnessing solar energy. Several factors support the feasibility

of solar energy systems in our country. These include the availability of ample silicon mines

covering 90% of the land, which serve as raw materials for the production of photovoltaic cells.

Additionally, there are vast unused areas suitable for the installation of solar systems, providing

an opportunity for the gradual replacement of fossil fuel power plants. This transition allows the

utilization of fossil fuels for higher-value applications, enhances energy security, positively

impacts employment opportunities—particularly for the educated workforce—while being

environmentally friendly, sustainable, profitable for the national economy, promoting distributed

generation, and reducing dependence on the national grid.

From a technical perspective, photovoltaic systems offer unique advantages. They can be

installed in any location and are compatible with diverse topographical conditions. They enable

on-site generation, eliminating the need for extensive transmission and distribution

infrastructure. As they operate without fuel requirements, they minimize associated costs.

Photovoltaic systems can produce varying outputs in accordance with consumer needs, offer the

capability of energy storage, and are characterized by ease of installation, operation, and

maintenance.

The annual average on solar irradiation in Iran, period 1999-2015

Wind Energy

Iran has great potential for harnessing wind power, with over 100,000MW of potential installed

capacity. As the demand for electricity continues to rise, Iran recognizes the advantage of its

excellent topography and geography for wind power generation. Consequently, the Iranian

government has prioritized wind energy over other renewable sources. It is projected that

approximately 4,500 MW out of the proposed 5,000 MW increase in renewable capacity will be

derived from utility-scale wind farms established throughout the country.

Located along major wind corridors, Iran’s northwest and northeast regions experience consistent

high winds throughout the year. This consistency ensures sustainable access to wind energy.

Iran is well-placed to expedite the growth of its wind power sector. The country currently

operates 15 wind farms, and a significant portion of the components used in their development

are locally produced. Leveraging its abundant human capital, Iran has developed technological

capabilities in turbine, generator, and inverter production.

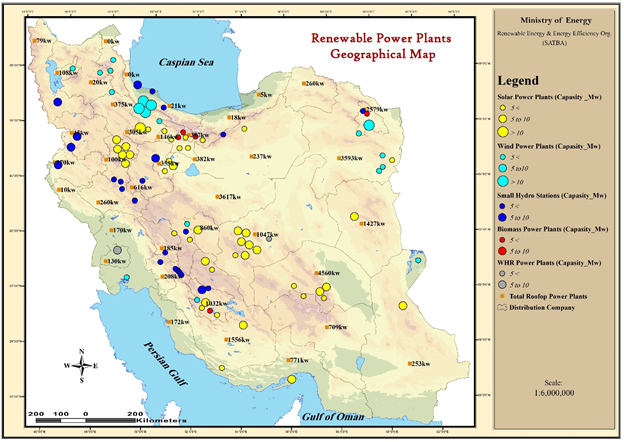

Renewable Energy Power Plants

The current total installed power capacity of Iran is 77GW, and the government plans to increase

this to over 100GW in the next few years. However, renewable energy sources currently

contribute less than 1% to the total power generation, with gas-fired combined cycle and steam

plants dominating the energy mix. Over the past decade, electricity consumption in Iran has

steadily risen, with an average year-on-year growth of over 7%. The industrial sector is the

largest consumer, accounting for 34.6% of electricity usage, followed by residential (31.7%),

agricultural (16.3%), public services (8.8%), and commercial (6.6%) sectors. Some sources

predict that with an increase in manufacturing and construction, overall consumption could reach

444,000 GWh by 2030.

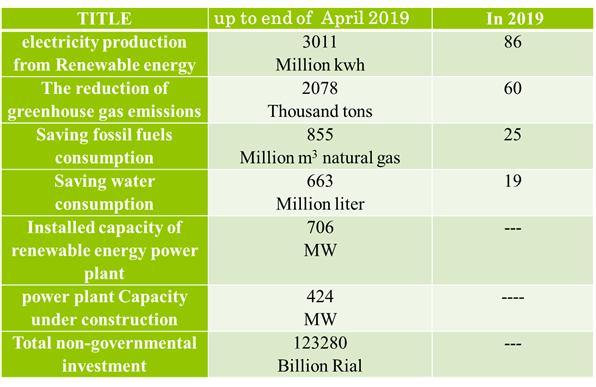

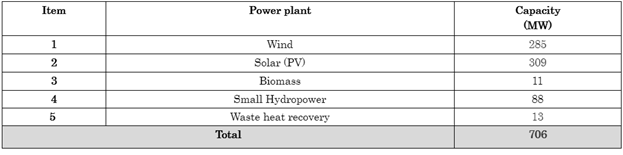

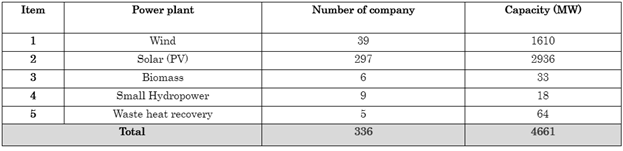

Installed renewable energy power plants situation up to end of April, 2019 in Iran

Following the 5-GW target to install renewable energy power plants by 2020, many companies have started installing procedure. Fortunately more than 4 GW PPA has been issued to install renewable energy power plants in Iran. Nearly 3 GW of that is belonged to solar power plants. Only one year is remained to implement the 5-GW target, so it can be a wonderful opportunity for investors to invest on and make an outstanding business. As it is mentioned above, the incentive policies and the attracting feed in tariffs are suitable parameters to consider investing on renewable energy in Iran. The number of companies who have obtained PPA is shown in the table below with their capacity.

Companies with renewable & clean power purchase agreement (PPA) up to end of April, 2019 in Iran

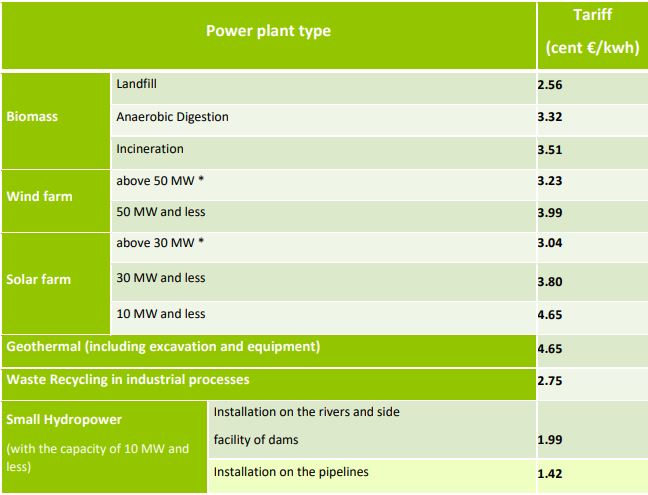

On the implementation of the legal obligations of Iran’s ministry of energy, the guaranteed electricity purchase feed-in tariff for types of renewable and clean energy are notified as follows:

1.Power purchase agreements for power plants covered by this announcement will be

extended for a period of 20 years, with specified tariffs during the contract years. The

tariffs will be adjusted based on the coefficient outlined in Article 3 of the Economic

Council Directive.

– Note1. Tariffs mentioned for all power plants covered by this announcement, except

wind farms, will be reduced by 0.7 after the adjustment outlined in Article 3 of the

Economic Council Directive. This reduction will apply starting from the first day of the

second 10 years until the end of the contract.

– Note 2. Tariffs for wind farms with a capacity factor of 40% and above in the first 10

years will be multiplied by 0.4 after the adjustment outlined in Article 3 of the Economic

Council Directive. It will apply starting from the first day of the second 10 years until the

end of the contract. Power plants with a capacity factor of 20% will have their tariffs

multiplied by 1, while a suitable coefficient will be applied for capacities between 20%

and 40%.

2. For power plants connected to the distribution grid, transmission services rates will be

added to the base rate as specified in Note 3 of Article 2 of the Economic Council

Directive.

3.The 20-year power purchase agreement begins from the contract’s effective date and

includes the construction and progress period of the power plant. During this period,

investors are allowed to sell electricity nationwide through bilateral agreements, energy

exchange markets, or other forms approved by Iran’s Ministry of Energy. The export of

electricity from renewable and clean power plants is subject to separate permits.

4.Tariffs will be proportionally increased up to 30% in accordance with the instructions

stated in Article 6 of the Economic Council Directive for power plants constructed using

local equipment, technologies, know-how, design, and manufacturing.

5.The base tariff will be determined under the following conditions if the applicant intends

to enter into multiple contracts for constructing renewable power plants.

a) For lands located in one or two main locations, the base tariff for each power plant will be

based on the total capacity of permits

b) The purchase rate for power plants owned by one applicant and connected to one substation or

distribution will be specified based on the total capacity of permits.

c) Except for other than a and b, the purchase price for each power plant will be independent and

based on the capacity of that specific power plant.

However, each applicant can have a maximum of two construction permits. Granting

construction permits for additional power plants requires the commercial operation of previously

constructed power plants.

– Note 1. : If it is determined that clauses (A) and (B) have not been observed during the

contract period, the power purchase agreement for the relevant power plant will be based

on a revised lower rate. The seller is obligated to refund any excess funds received as per

the contract’s purchase content.

– Note 2. The term “applicant” refers to legal entities with shareholders, individual

shareholders, and any legal entities.

– Note 3. In the case that new contracts are notified after the commercial operation of the

previous contract, the base rate for the new contract’s electricity purchase will be

determined according to the capacity of the new power plant, even if conditions

mentioned in clauses (A) and (B) are included.

6. Power purchase agreements are prohibited for power plants that used state grant funds for

their construction. Investors must guarantee and commit that state grant funds were not

utilized for the power plant’s installation.

7. The rates specified in this announcement apply to contracts where the power plant’s

construction and commercial operation are completed within a maximum of 30 months

for biomass, geothermal, and small hydropower plants; within 24 months for wind power

plants, waste heat losses in industrial processes, and turbo expanders; within 18 months

for fuel cell systems; and within 15 months for solar power plants, counting from the

contract’s notification date. In case of delay, the last approved base rate by Iran’s Ministry

of Energy on the commercial operation start date or the mentioned rate (whichever is

lower) will be applied for the remaining contract period.

– Note 1. In the event of a delay of up to 9 months beyond the specified commercial

operation timeline of a power plant, the Renewable Energy and Energy Efficiency

Organization (SATBA) has the authority to terminate the power purchase agreement,

revoke the construction permit, and refund any state lands designated for the power

plant’s construction through the appropriate authorities. Should there be partial operation

of the power plant, both the construction permit capacity and contract will be

proportionally reduced, and the remaining state lands will be refunded.

– Note 2.Requests for new contracts from investors whose contracts have been terminated

by SATBA will not be considered until two years after the termination notification.

8. The Ministry of Energy in Iran will oversee the implementation of the renewable and

clean power plants policy, aiming for a maximum yearly development of 2000 MW by

the private sector. SATBA is responsible for making necessary arrangements for the

policy’s execution.

9. The Ministry of Energy in Iran will gradually reduce the rate of the guaranteed power

purchase agreement for clean and renewable power plants, taking into account the

increase in capacity of these plants and the availability of financial resources. The

reduced rate will only apply to new contracts. It is important to note that the purchase of

electricity from fuel cell systems relies on the storage of electricity generated by other

renewable sources at the generating location